Award-winning PDF software

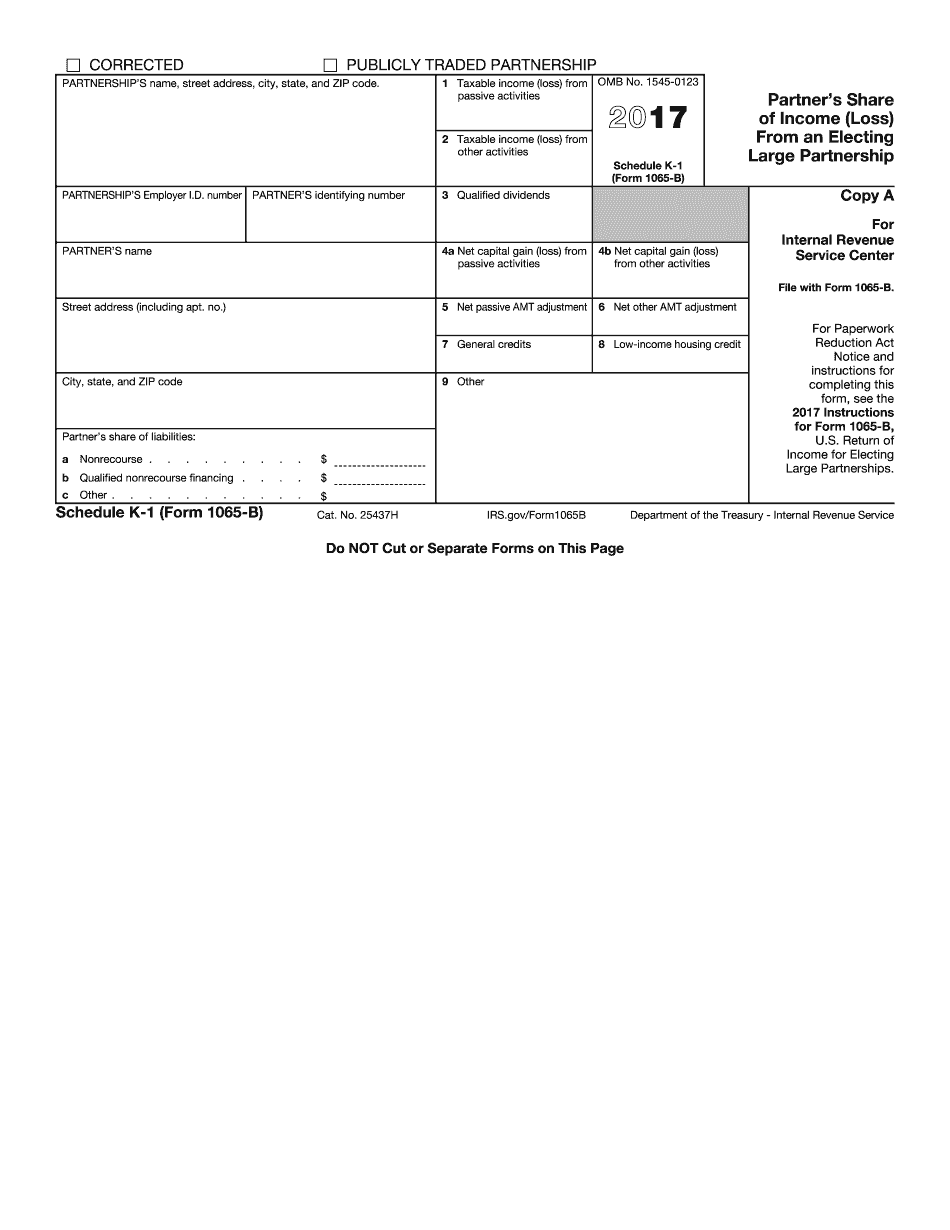

1065 instructions Form: What You Should Know

The draft instructions replace the draft for 2024 which was released on August 2, and are being issued pursuant to Treasury final requirements in Public Law 115-29, as amended (P.L. 115-29). The 2024 draft instructions for the U.S. partnership tax return was developed following guidance from the U.S. Department of the Treasury's Office of Tax Policy (ITS). It was the result of a comprehensive review of the draft and final regulations. The 2024 draft guidance was posted to ITS' website in early October. The revised draft will follow a series of open online comments from April 13 to April 26, 2018, before being published as final guidance in late May. 2022 — Partners Instructions for Schedule K-1 (Form 1065). This schedule lists each partner's income on which tax is to be imposed by this chapter. (C) = Tax must be paid by the partner. A. Income received and income reported as dividends from a REIT (in which no deduction is allowed for contributions) are tax-exempt. B. Income from a partnership property is not excluded from the taxable income of the partnership. C. Capital gain distributions from a partnership are not excluded from the taxable income of the partnership. D. Net investment income is not tax-exempt. F. Income from a qualified conservation easement or a qualified farming or fishing lease is tax-exempt if it does not constitute a sale of real property, G. Income from any other property is taxable if it constitutes the use in commerce of real property, unless the property is held as held for investment or the fair market value is greater than the fair market value of the real property. For example, any gain from the sale of securities, or any gain from an excess contribution to a trust held in connection with a qualified conservation easement, is not income if less than the qualified conservation easement or the qualified farming or fishing lease. The table below shows the income tax consequences of partnerships: Table 1 — Income and Expenses Related to Partnerships Note: If the partner's income is income in which all or part of the partnership's share of a cost of service is includible in the partners gross income and expenses are allocated proportionately to the partnership's share of any part of the cost of service, then the partners' income is treated as having been allocated to the partnership. For more information see Notice 2009-42.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Schedule K-1 (1065-B), steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Schedule K-1 (1065-B) online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Schedule K-1 (1065-B) by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Schedule K-1 (1065-B) from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.