Award-winning PDF software

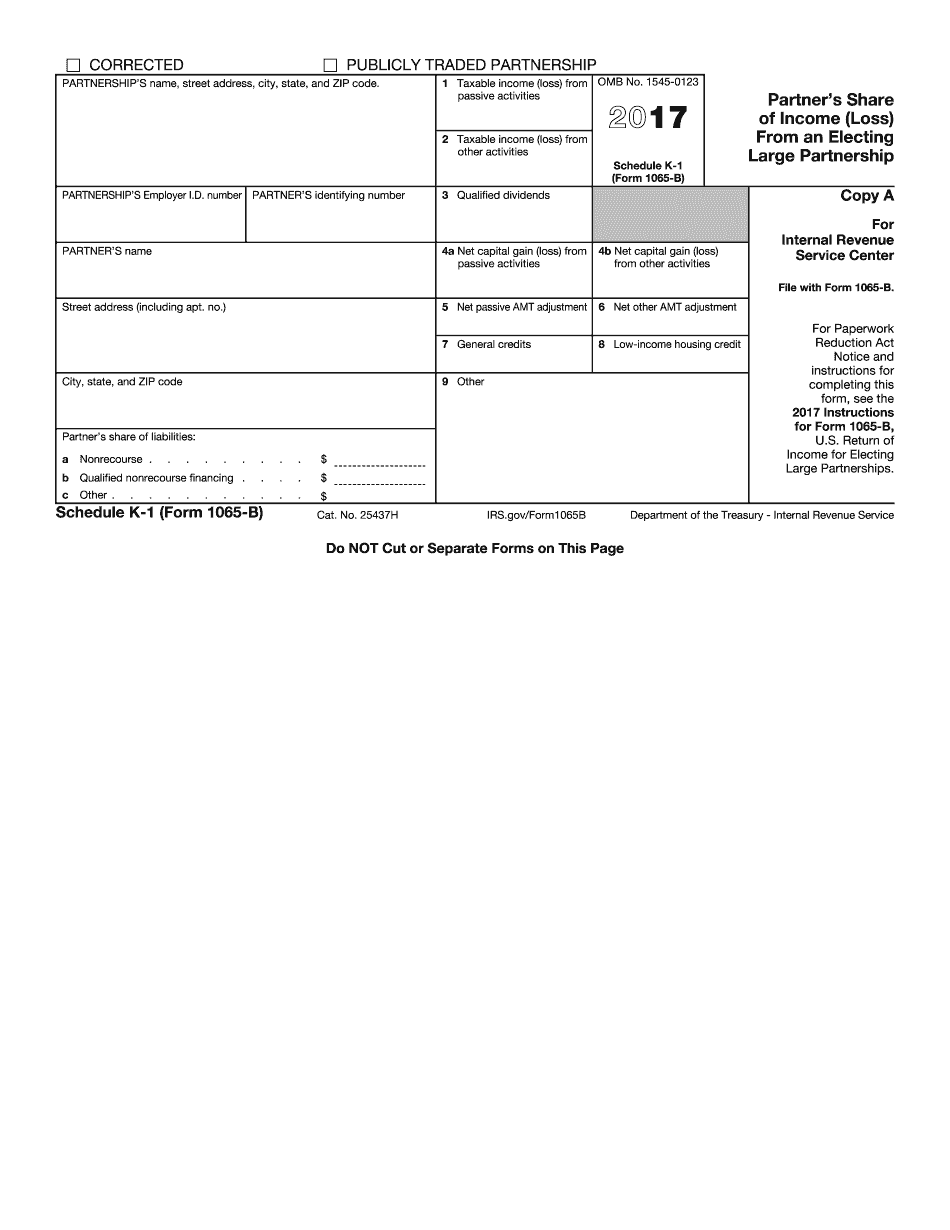

Chula Vista California online Form Schedule K-1 (1065-B): What You Should Know

Definitions. “Qualified Federal Taxpayer” means a person who reported, on Form W-2 or Form 941, or on the return or statements required to be filed with the California State Board of Equalization, a gross income of 200,000 or more for Tax Years January 1 through December 31, 2020, and any income made from nonresidential real property in California during the 12-month period immediately preceding the calendar year. (3) Special rules to assess income. The following rules apply where the individual is claimed as an individual, or as a member of a partnership or limited liability company, and is unable to provide the information needed to determine tax liability: Where the individual is claimed as an individual the Service Center will determine who the individual is by examining Form W-2 or Form 941, including determining such information as the individual's: Full name; Full address; Date a return was filed; Type of business; and Date the individual joined the entity or company. If information on Form W-2 or 941 is missing, or is inconsistent with other information provided by the individual, information will be relied upon by the Service Center as a final determination. A request that an individual be reviewed on the basis of his or her own tax return is a request that the Service Center make a preliminary determination of a tax deficiency for which the individual is required to pay tax. It will not be considered by the Service Center as a request for an immediate final determination. To request an individual's prior year tax return information from the IRS, the Service Center has established this website: . A paper copy is available from the Service Center located at: 56700 Ventura Blvd., 9500 S. Fairfax Blvd., Woodland Hills, CA 91364;. (4) When will the IRS determine if the individual is entitled to claim Section 6517(a) of the Internal Revenue Code and whether the individual is in fact a Federal or State Taxpayer? The Service Center will determine if the individual is a qualified Federal Taxpayer based on the information in the individual's return. If the taxpayer is a State Taxpayer, the Service Center will make a preliminary determination of State Taxpayer status based on the return and information in the relevant State Tax Return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Chula Vista California online Form Schedule K-1 (1065-B), keep away from glitches and furnish it inside a timely method:

How to complete a Chula Vista California online Form Schedule K-1 (1065-B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Chula Vista California online Form Schedule K-1 (1065-B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Chula Vista California online Form Schedule K-1 (1065-B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.