Award-winning PDF software

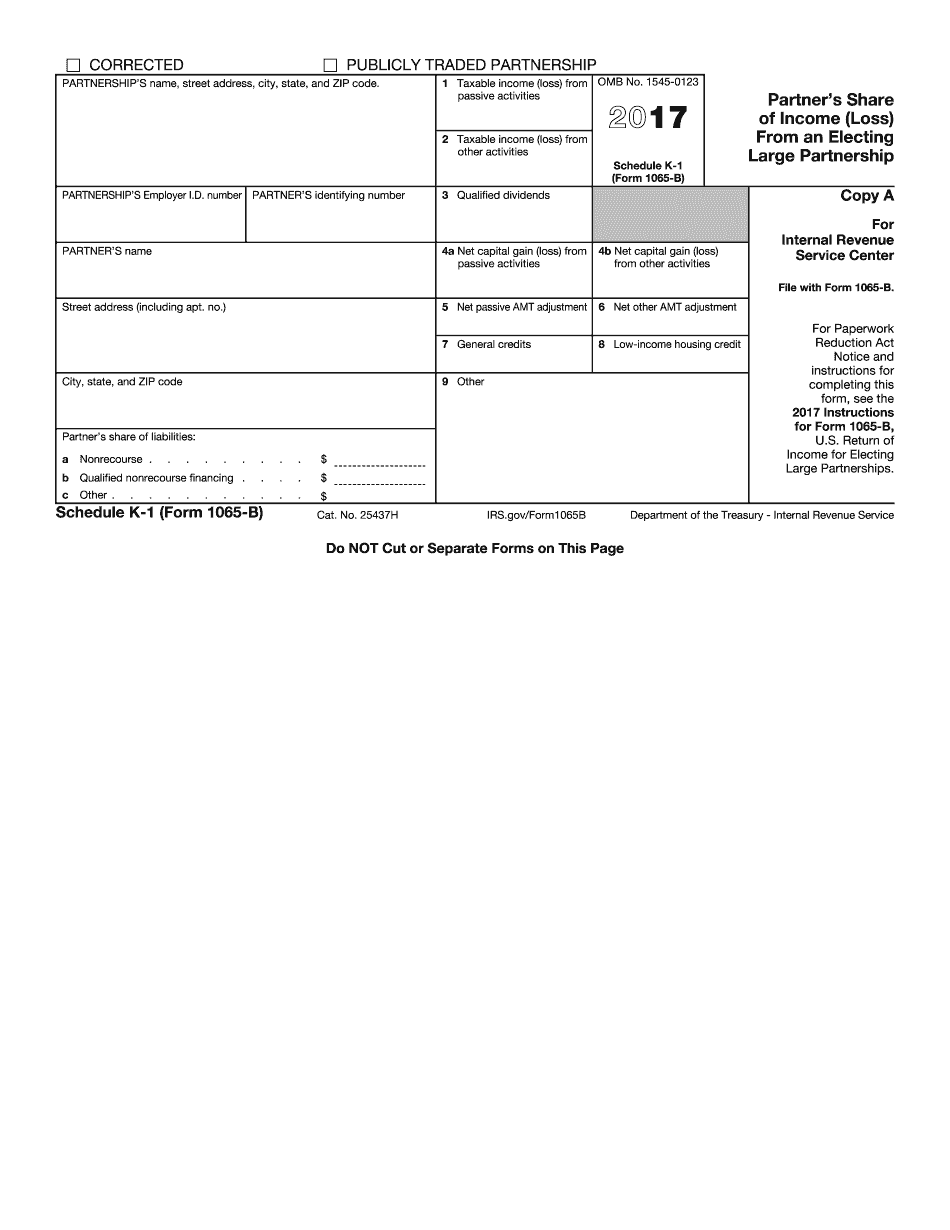

Form Schedule K-1 (1065-B) for Waterbury Connecticut: What You Should Know

Box 5C, to report the qualified capital contributions made to a partnership for a qualifying organization. Oct 1, 2024 to code M of Schedule K-1 (Form. 1065), box 5F, to report each partner's share of qualified dividends or restricted dividends paid to the partnership. For all schedules, a tax-year return or the period of time covered by an adjustment is required. Please consult your account advisor if you have questions about how to document, prepare and file Form 1065. Connecticut Partners of Public Benefit Pension Funds A public benefit pension fund is a state or local employer benefit plan that provides retirement or other compensation for members and their dependents. Connecticut Partners of Public Benefit Pension Funds are taxpayers who: Are eligible to make contributions to a plan under section 401 (a), 403(b), or 408 (k) of the Internal Revenue Code, section 4975(f) of the Connecticut General Statute or a regulation of the Connecticut Public Benefits Corporation, and make such contributions on behalf of their employees. Are members of such a plan as of December 31, 2015, to April 30, 2016. (If you are a non-resident, you do not lose any deductions made by the fund or its affiliates on your gross wages to the extent they exceed 200,000 or 527 per month.) Pension Funds The funds may be defined as pension contracts which are not subject to taxation. The term “pension fund” is generally defined as the public pension plan established to pay all or part of a pension liability. The funds are usually publicly funded pensions, but also a range of private fund arrangements. If you meet all the eligibility criteria, the funds will pay your pension for you. The state of Connecticut provides a list of these funds. Connecticut Partners of Public Benefit Pension Funds must be able to file Form CT-1065-1; if they are under 250,000 in total assets, they must file as an S corporation. Connecticut Partners of Public Benefit Pension Funds may also be eligible for a form CT-1120SI, Partnership Information Statement. The form provides you and your public benefit pension fund a statement of your partnership. Please consult your fund advisor for your requirements.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Schedule K-1 (1065-B) for Waterbury Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form Schedule K-1 (1065-B) for Waterbury Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Schedule K-1 (1065-B) for Waterbury Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Schedule K-1 (1065-B) for Waterbury Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.