Award-winning PDF software

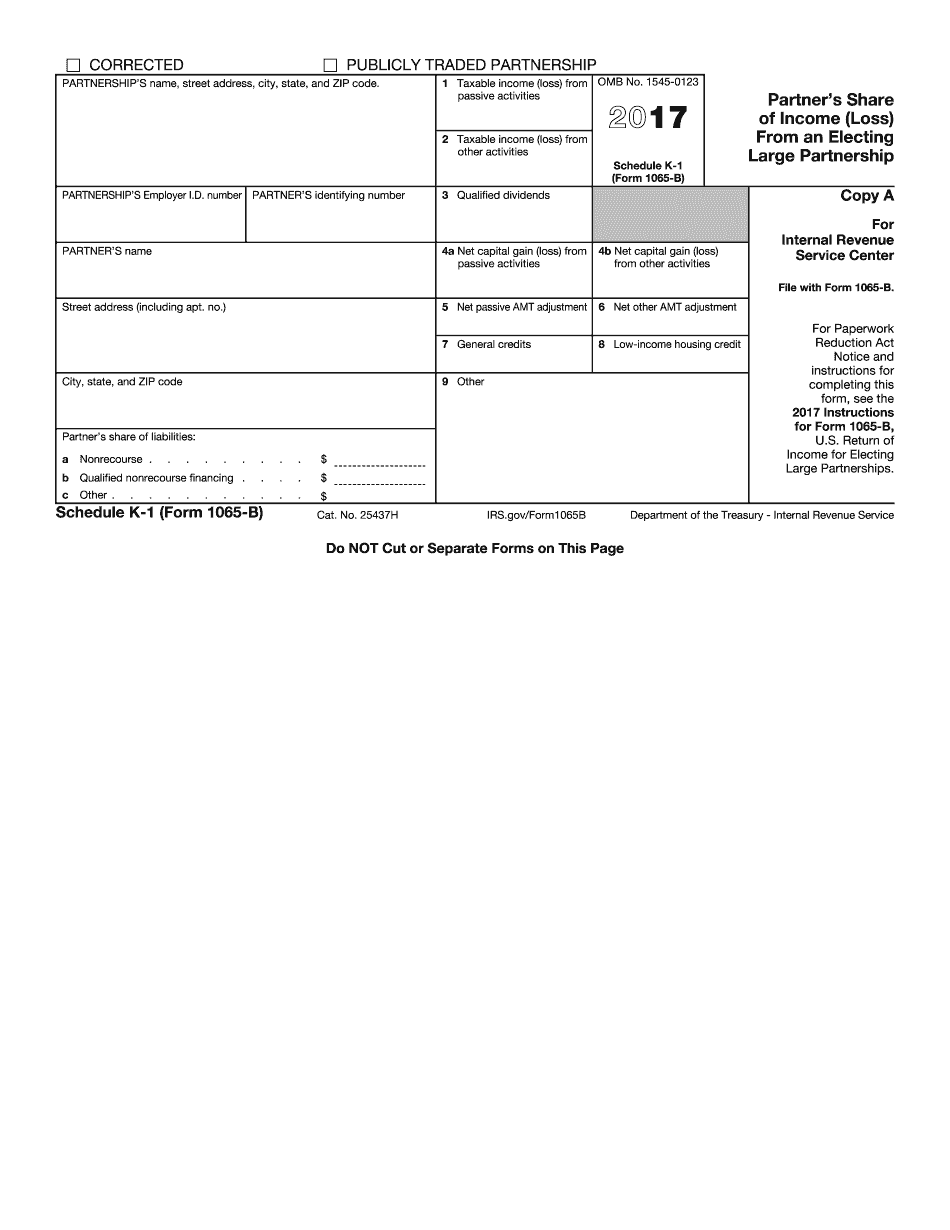

Form Schedule K-1 (1065-B) online Fayetteville North Carolina: What You Should Know

Form 1065 (Form 1040 or 1040A) or to request and pay an additional 6-month extension of time to file the Schedule K-8 (Form 8830 or 8831), partners should complete the Online Partner Extension Form at this link and print. If you are requesting an automatic 6-month extension of time to file the Form 1065 (Form 1040 or 1040A), you may send the completed form to the address below and have a representative send the completed form by overnight shipping or courier service to the address below. If you need additional assistance, please call the firm at for further instructions. You may now electronically access your partner's Partner's Guide to Form 1065. To view the Partner's Guide, download the Partner's Guide PDF at this link. (If you are a domestic partner, contact the firm directly by using the email address on ), or contact us by visiting our partner portal at this page and selecting to join us as a partner. Partners and Partners-in-Interest: It is very important for us to make sure that each of our domestic partners can understand their responsibilities under the law. As you receive the 1065 form, ensure that you have checked the box indicating that it is a joint return, as described in section 704 (a)(1) or paragraph (o) of section 704 (a)(3) of the Form 1065. If you and your partner filed separate tax returns (or if you were one of two persons or if you and your partner were married and the tax returns were filed on separate schedules), there may be penalties and interest associated with this information. See IRM 21.3.4.8.3, Penalty Assessment, if you did not file separate returns and do not believe that you owe back taxes or interest. Note: If you are a participant in the tax refund programs, see IRM 21.5.1.1.5.9, Exemptions Based on Participation in Certain Tax Refund Programs. If our joint return was not filed on time, a penalty of 25% of your total return will be assessed until we file the joint return. The amount will be calculated by dividing 25% (the percentage) by your last reported tax before your joint return was due — (the amount reported), rounded down to the nearest dollar, multiplied by 12 months.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Schedule K-1 (1065-B) online Fayetteville North Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form Schedule K-1 (1065-B) online Fayetteville North Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Schedule K-1 (1065-B) online Fayetteville North Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Schedule K-1 (1065-B) online Fayetteville North Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.