Award-winning PDF software

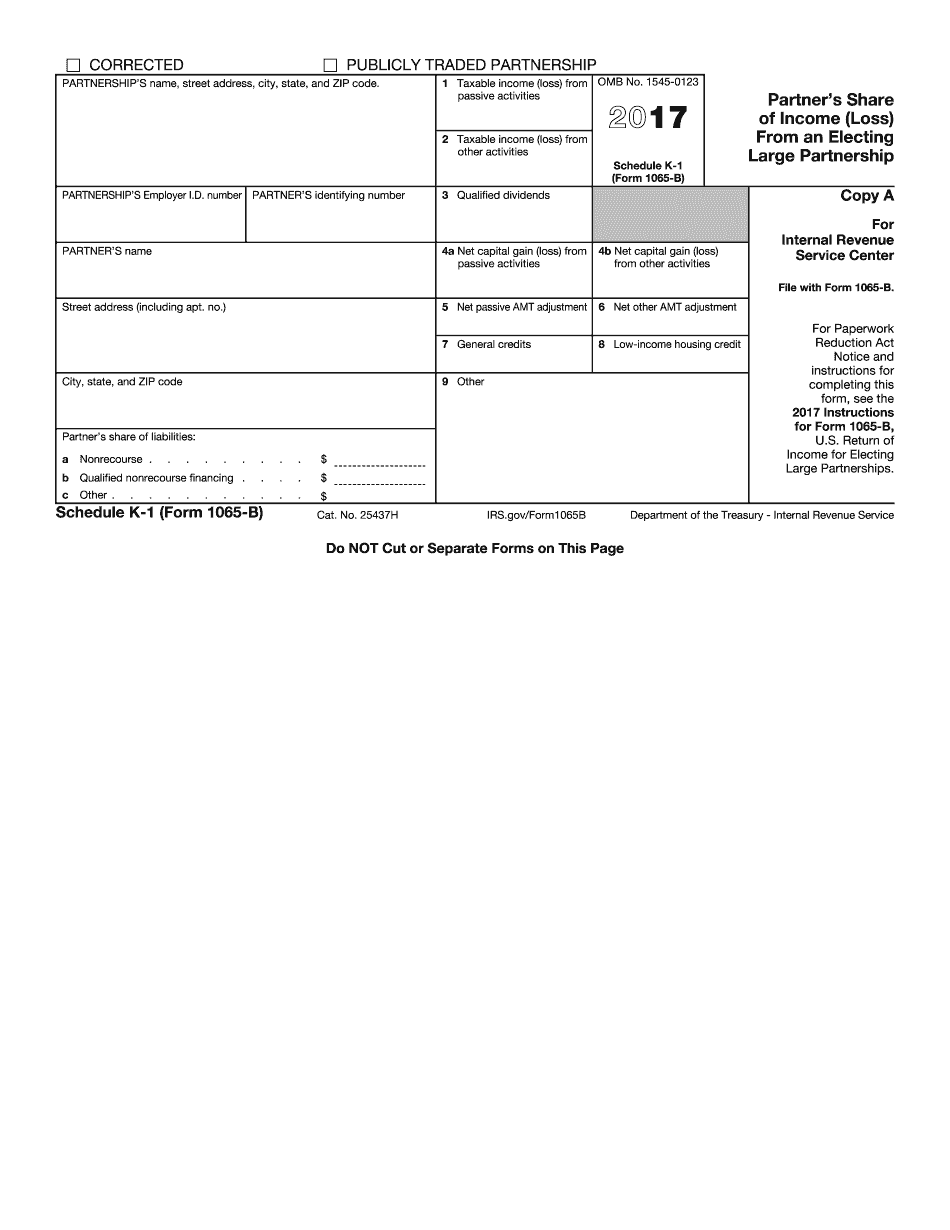

Spokane Valley Washington Form Schedule K-1 (1065-B): What You Should Know

Federal estate and gift tax. 3. Federal employee, railroad, or federal excise tax. 4. Social security and Medicare taxes. 5. Federal estate tax; State and local tax (property and sales tax) 6. Federal Unemployment (FTA) tax. 7. Federal employment tax. 8. State and local income tax and franchise tax. 9. State, local sales tax, and property tax. 10. Federal credit for electric and natural gas utilities. 11. Foreign earned income exclusion. 12. Railroad retirement tax. 13. Education tax. 14. Federal unemployment tax credit. 15. Federal personal property tax. 16. Federal medical expense tax. 17. Individual shared responsibility payment. 18. Medicare part A; Medicare part B. 19. Federal Railroad Retirement tax. 20. Railroad retirement tax credit. 21. Railroad retirement tax. 22. Railroad excise tax. 23. Small business exchange. 24. Small business job search. 25. Student loan interest deduction. 26. Jobless insurance premium tax credit. 27. Health insurance tax credit. 28. State and local sales tax. 29. Gasoline excise tax. 30. Mortgage interest and property tax. 31. Small business job search. 32. State unemployment tax credit. 33. Small business credit for electricity generated from nuclear power plants. 34. Small business credit for electricity generated from renewables. 35. Small business credit for electric power purchased with renewable energy credits or renewables energy credits. 36. State unemployment tax credit. 37. Individual shared responsibility requirement. 38. State general sales or use tax. 39. Federal tax for certain insurance payments. 40. Medical expense deduction. 41. Federal withholding tax. 42. State income tax. 43. Foreign income tax. 44. Estate tax. PARTNERSHIP'S name, street address, city, state, and ZIP code (if a partner). 1. Taxable income (loss) — Passive assets: • Partnership income. • Partner's investment interest in a partnership. • Distributions of capital or profits. • Interest, dividends, or other income. • Income-producing property. • Any gain that occurs directly or indirectly from the sale or exchange of any asset. • Profit on the sale or exchange of any investment, other than capital gain. 2. Federal and state tax on passive assets. • Capital gains rate. See below.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Spokane Valley Washington Form Schedule K-1 (1065-B), keep away from glitches and furnish it inside a timely method:

How to complete a Spokane Valley Washington Form Schedule K-1 (1065-B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Spokane Valley Washington Form Schedule K-1 (1065-B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Spokane Valley Washington Form Schedule K-1 (1065-B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.