Award-winning PDF software

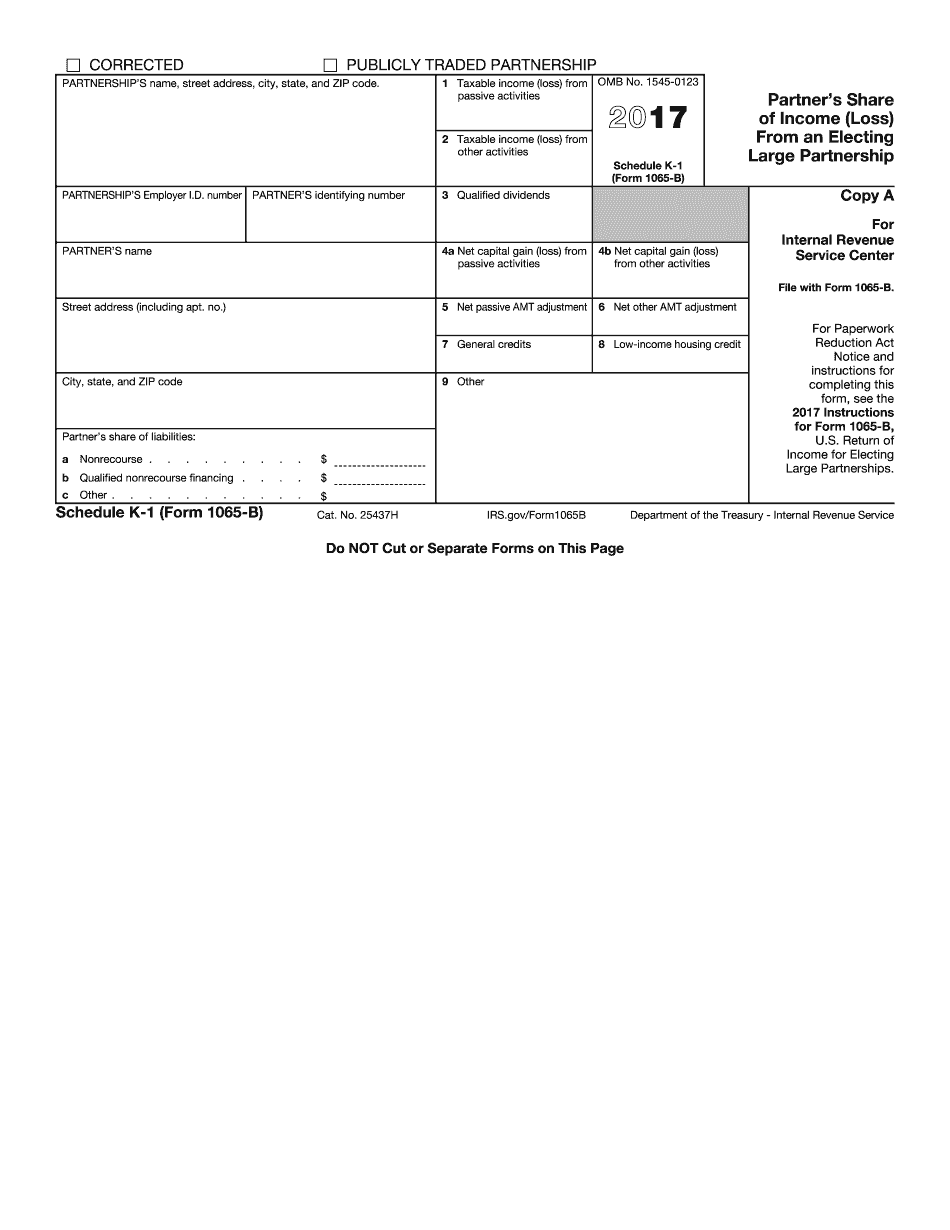

West Jordan Utah Form Schedule K-1 (1065-B): What You Should Know

The Online Franchise Tax Information System (FITS) is an online clearinghouse for filing requirements for franchise tax. FITS will collect and maintain information on all required Franchise Tax Returns (Fans) and Franchise Tax Information Returns (FTIR) required by state and local taxing authorities. Forms for Establishing Tax Involvement in Sales of Services (TIN) and Franchising Agreements (FAM) are updated on a frequent basis from Texas Department of State Health Services (DSS) and Franchise Tax Services (ITS) website. 2021 Texas Statutory Rules and Regulations (TCR): Texas Franchise Tax Act If you need an additional tax for franchise tax on goods, services, or property sold in Texas, you'll need to file these TCR-1 forms. The Texas Franchise Tax Act (TCA) authorizes the State Comptroller of Public Accounts to establish a sales tax rate to be applied to the gross amount of items purchased from the United States, or as determined to be the equivalent in Texas sales, on the date of sale. A qualified sale occurs at any location in this state. The TCR-1 is intended to be used as the legal basis for all transactions related to franchise tax. 2022 Texas Franchise Tax Act (TCA) (PDF) Texas Franchise Tax Act (TCA) (PDF) The Texas Franchise Tax Act, Code of Ordinances, or this TCR-1, establishes the Texas franchise tax. In addition, this document establishes procedures for calculating the net income for an individual subject to Texas franchise tax, as well as the tax rate, if applicable. (Sec. 5.31(a).) The TCR-1 applies to persons or entities engaged in operating or conducting a tangible property or service enterprise engaged in the regular, ordinary course of business, that operates in this state. The TCR-1 also applies to transactions between Texas residents. Any person or entity that fails to file a Form 527 for the year shall pay no gross income tax on its gross income as a Texas resident or nontransient entity, unless the failure is due to reasonable cause and not willful. Any person or entity that fails to file a Form 527 for the taxable year shall pay no excise tax on gross income as a Texas resident or nontransient entity, except as provided in a tax law.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete West Jordan Utah Form Schedule K-1 (1065-B), keep away from glitches and furnish it inside a timely method:

How to complete a West Jordan Utah Form Schedule K-1 (1065-B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your West Jordan Utah Form Schedule K-1 (1065-B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your West Jordan Utah Form Schedule K-1 (1065-B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.