Award-winning PDF software

Form Schedule K-1 (1065-B) for Palm Beach Florida: What You Should Know

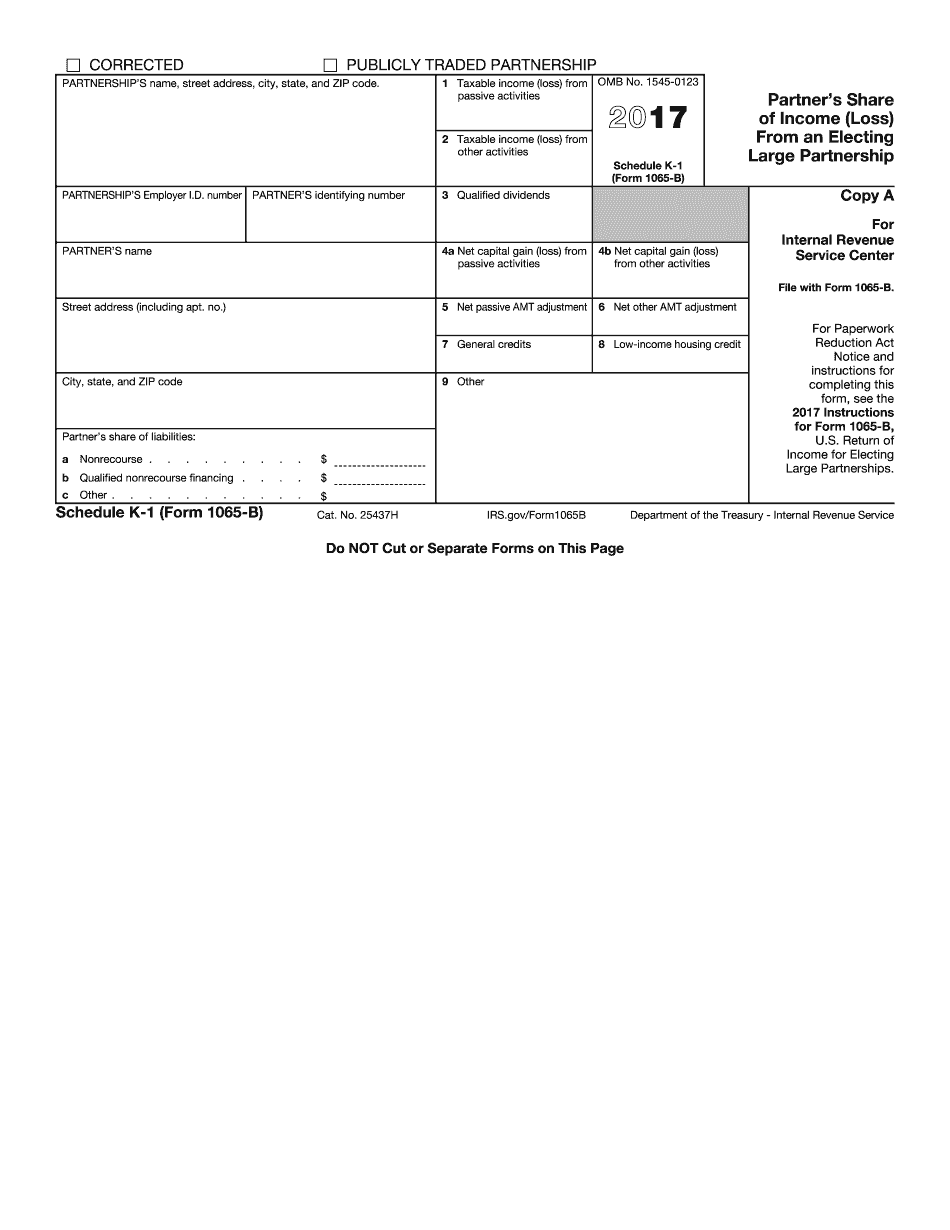

Form 1065, U.S. Corporate Income Tax Return. Taxpayers may, if eligible, use Schedule K-1 for Schedule L on their business return. Use Form 1095-A for Schedule RC for any other state taxes due on the return. Forms 1095-B, 1095-C and 1095-D can be used to report the state sales and use tax. IRS Forms 1095-B, 1095-B-EZ, 1095-EC and 1095-S-X may be used to report special income (as defined by the state in which a business is doing business). Forms 1095-B-EZ, 1095-EC and 1095-S-X can also be used to report the foreign withholding tax payments (the actual taxes withheld) from the mayor and payee (you, the business, the employee) and remitted to the IRS. Forms 1094-C and 1094-D, Tax Withholding and Estimated Withholding Form 1094-C and 1094-D are used to report the withholding tax due from the payee for Form 1095-C and/or Form 1094-D. IRS Forms 1098 and 1095-EZ, Report withholding and estimated withholding on business income you get from your foreign tax jurisdiction. The IRS Form 1098 is used to report the withholding taxes and/or estimated withholding from domestic sources. For any income that is not shown on Form 1097, you will be required to use Form 1040X. IRS Form 1065, Summary of Gross Income of Partnership Income Report gross and net income on Schedule K-1 in Schedule F. You will find a new code U under Line 7 in Schedule K-1 to report your distributive share at partner level. This means that you now report income at the partner level as a “split income” instead of line 21 which used to show income at the individual level. Line 6, line 8, line 18 and line 21 of Schedule K-1 under Schedule F IRS Form 1065, Summary of Gross Income of Partnership. (Form 1065), U.S. Business Income Tax Returns If your partnership filed a Form 1065 at any time, you should find a new line 6 and a new code U under Line 7 of Schedule K-1 to report the distributive share at partner level.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Schedule K-1 (1065-B) for Palm Beach Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form Schedule K-1 (1065-B) for Palm Beach Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Schedule K-1 (1065-B) for Palm Beach Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Schedule K-1 (1065-B) for Palm Beach Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.