Award-winning PDF software

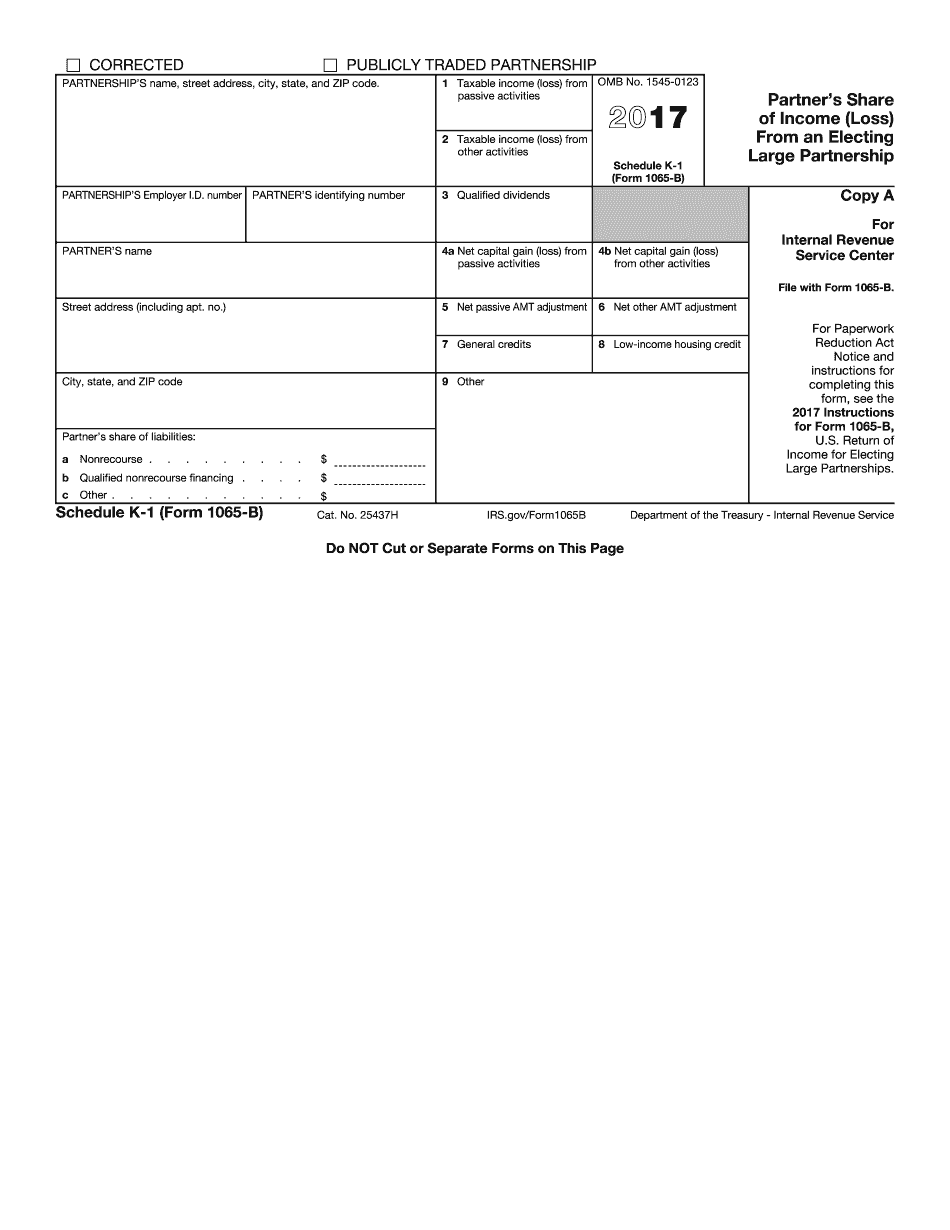

King Washington Form Schedule K-1 (1065-B): What You Should Know

July 1, 2024 — Tax day, 2024 U.S. government is working through 2024 tax form 1139 which is supposed to reduce the number of taxpayers reporting income in foreign countries to reduce the U.S. deficit and increase U.S. investment incentives, tax reform is still the most important tax reform under consideration in 2024 which is a bipartisan goal as evidenced by the current GOP tax reform bill. The IRS will provide a status on 1040Q reporting in late 2024 or early 2019. AICPA Tax Form Nov 13, 2024 — I had two emails from the Internal Revenue Service (IRS) regarding the current status of a 2024 U.S. income tax return that was filed on line 12 of Form 1040 Schedule A. The 2 Schedule A was filed using the same address as the 2 Schedule A for the same taxpayer, so I suspect that it was an error and no change has been implemented. The 2024 Form 1040, Schedule A is not in IRS' electronic system, and I've asked for confirmation on which system it was submitted, the paper 990 or electronic 1040. Nov 12, 2024 — I received this news from Chris Learner of KPMG: The Internal Revenue Service (IRS) has started sending notices to taxpayers with certain large partnerships and limited partnerships reporting information in errors when completing their 2024 Form 990-C. Here is a link to the article regarding the error in 2024 Form 990-C that caused the information to not be entered in error: I have a meeting on Nov 21, 2024 and am I looking to submit additional info to the meeting. (I have my schedule). I had a question in the tax return process, so I looked it up, and I found you had submitted the Form 990-C for the prior year to the IRS. How would I go about notifying the meeting? If you are planning to attend this year as a participant please contact me at. I plan to do this year as well. I received this news on Nov 6, 2024 from the same news outlet: The IRS has already sent notices to many taxpayers who did not file a required Form 990-C (U.S. Individual Income Tax Return) for 2024 and may need to resubmit those returns to complete the income tax extension process.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete King Washington Form Schedule K-1 (1065-B), keep away from glitches and furnish it inside a timely method:

How to complete a King Washington Form Schedule K-1 (1065-B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your King Washington Form Schedule K-1 (1065-B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your King Washington Form Schedule K-1 (1065-B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.