Award-winning PDF software

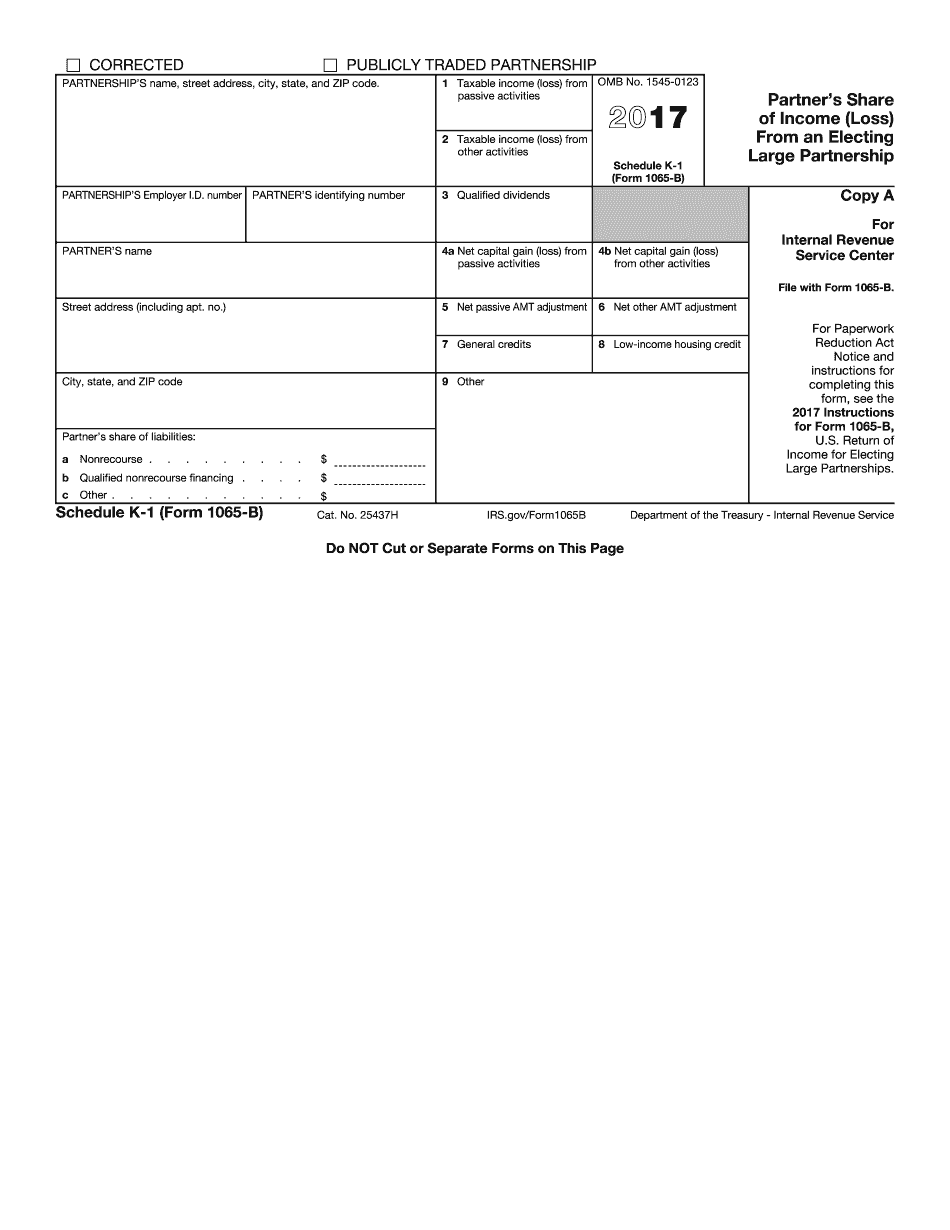

Oakland Michigan online Form Schedule K-1 (1065-B): What You Should Know

Section 1014(a) of the IRC. See instructions. (Not a complete list, a partial list is shown to the right). 23(a), (b) and (c)(1) of the Internal Revenue Code. Sections 6103(a), 6103(b), 6103(c)); see also, Revenue Ruling 72–564. 3. Section 705(a) of the IRC. See instructions. 6. Section 752 of the IRC. See instructions. This is the section that is most often referred to as the Alternative Minimum Tax (AMT). Section 757(2)(F) of the IRC (otherwise section 759). The following rules apply to the distribution tax paid by a corporation on a distribution to an S corporation. Rule 1: General Rule of Taxation : If the corporation's distributive share of income is 5,000 or more, no tax is required to be paid by an S corporation on a distribution to its shareholders. See section 757(2)(A). Rule 2: General Rule of Taxation : A corporation with any income that it gets and that can be distributed without being recharacterized, has no tax liability under Section 758 of the tax code or the alternative minimum tax. See section 758(b). Incentive Share Programs : If an S organization offers to transfer its shares to individuals or charitable organizations, the shares will be treated as a gift to the transferee as defined in §2634.712 of the Code. Then §2634.717(a) will apply if the stock is owned outright for more than 5 years. Then, §2634.707 applies if the shares are owned outright for at least 10 years. Then, §2634.706 applies if the shares are owned outright for at least 15 years. The distribution tax will not apply to distributions to an unincorporated organization that is engaged primarily in a religious or charitable endeavor. This rule applies to the S corporation's stock as long as there are not more than 3 shares owned. Incentive Share Program Distribution Tax The distribution tax is not part of the amount of the capital gain and the amount is taxed at ordinary income tax rates (not at preferential or accelerated rates). Section 759 : A.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Oakland Michigan online Form Schedule K-1 (1065-B), keep away from glitches and furnish it inside a timely method:

How to complete a Oakland Michigan online Form Schedule K-1 (1065-B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Oakland Michigan online Form Schedule K-1 (1065-B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Oakland Michigan online Form Schedule K-1 (1065-B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.