Award-winning PDF software

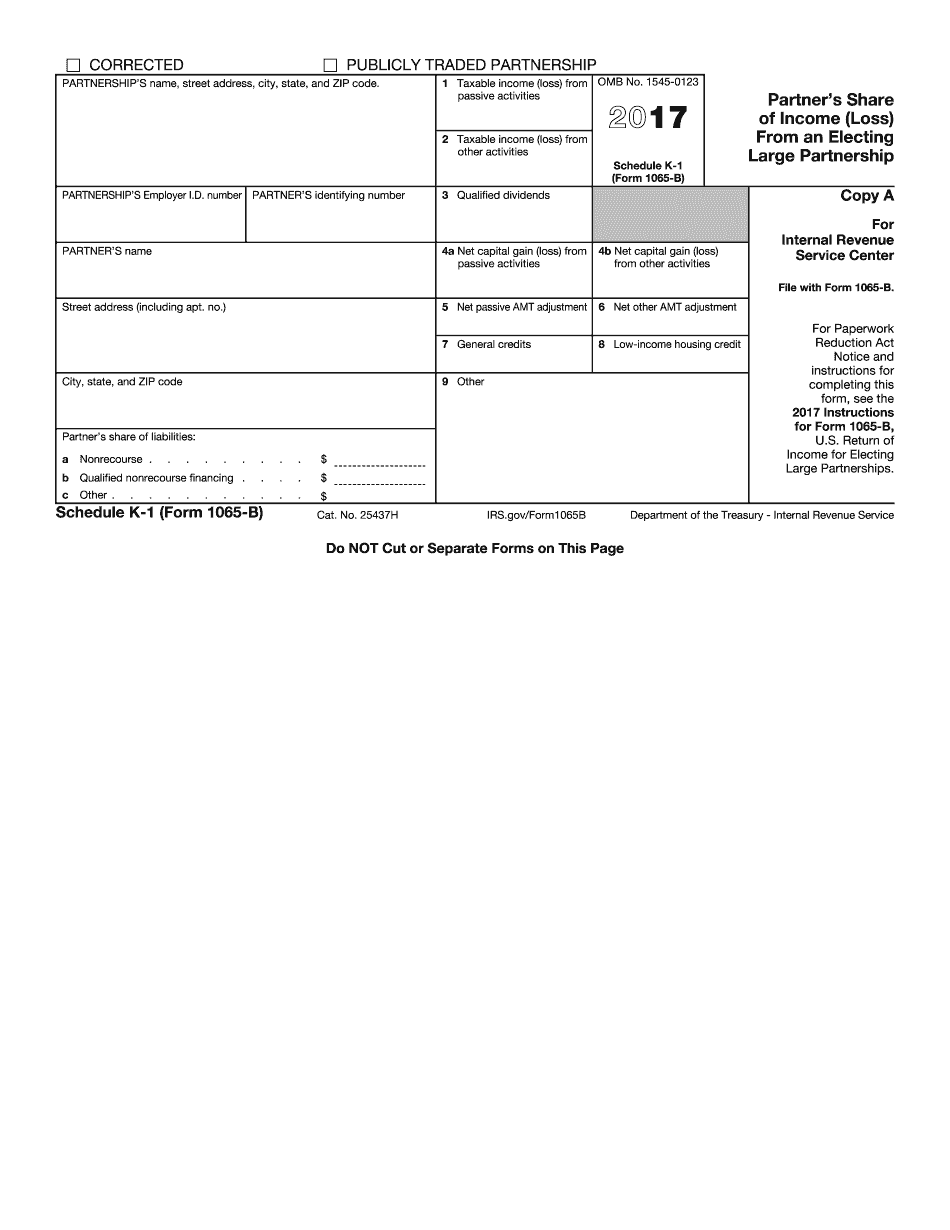

KS online Form Schedule K-1 (1065-B): What You Should Know

Line 24 is equal to the Kansas amount multiplied by 8. Line 26 is entered on Schedule K-121. The total of Kansas income on your tax return is 8% more than your total Kansas income due to income tax withholding, so this is your excess Kansas income. This amount is reported on Schedule GK-T. 2022 Filing a Federal Return: You should have a calendar quarter to file your Kansas return. Form 605 (the Kansas Individual Income Tax Return) will be used. You will be asked for your address in the box next to Form 605. If you do not, do not go to the Kansas Tax Commission and the Kansas Department of Revenue. Use your address on Schedule K-1. If you are filing an individual return, use Form 463, and Form 5310, unless you get form 463 from the IRS or Form 5310 from the Department of Revenue. 2023 Income tax has to be paid within the time frame given. 2027 When I called the Kansas Tax Commission they said that they could not help, they will try to help, but the state laws have to be followed. I will be contacting Kansas' Attorney General and Senator Jack Hatch, but do not hold them over. If the Attorney General or Senator Hatch will not help, I will file the Kansas return. 2029 I am in Kansas and filing at the beginning of the year. I am not sure of my return yet. I am currently using Form 605. 2031 I called them last Saturday and am I calling back this week. They said that I would have to file my return electronically. I called around and was not able to get anyone to help me. There is no web store for Form 605 and I cannot find any form 605 that is available for electronic filing, if anyone does, please let me know, and I will link you to a form. They were working on the Form 604. The problem is that Kansas law requires that the form be filed on the original, not a photocopy, and they don't have any form from the IRS. But I'm in Kansas, and I'm filing electronically, so I just have to wait. The next year should be easier. 2032 No. They said that filing my Schedule K-1 with the actual numbers can be done, but they could not provide any help figuring it out. They recommended that I ask around in the local tax community for the answers I needed first before spending on these types of issues.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete KS online Form Schedule K-1 (1065-B), keep away from glitches and furnish it inside a timely method:

How to complete a KS online Form Schedule K-1 (1065-B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your KS online Form Schedule K-1 (1065-B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your KS online Form Schedule K-1 (1065-B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.