Award-winning PDF software

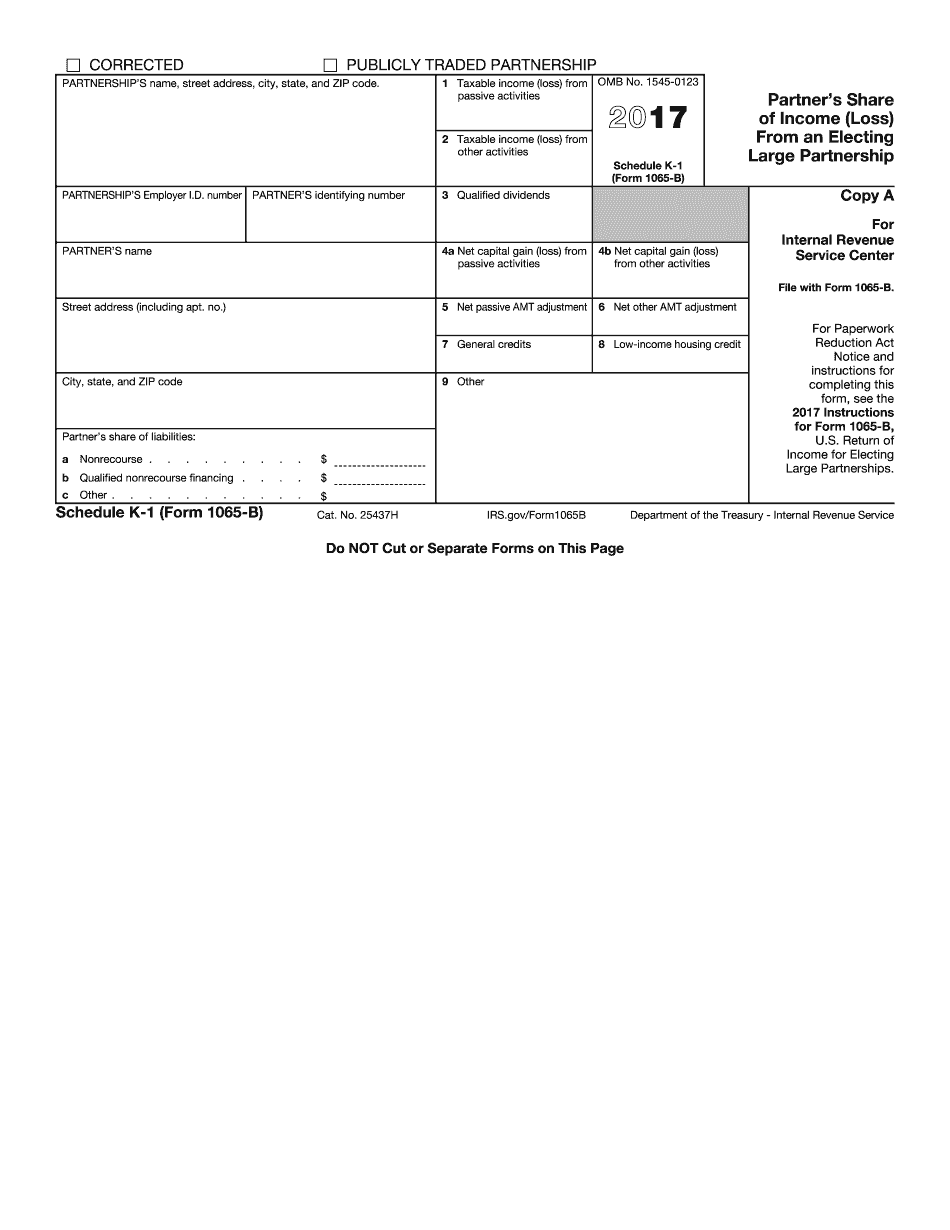

New Mexico Form Schedule K-1 (1065-B): What You Should Know

In addition to the information listed on this form to be filed, please note the following information that will be received by the IRS: FEDERAL, STATE and LOCAL RETURNS. Forms & Publications : Taxation and Revenue New Mexico The information on this page is intended solely for reference purposes. It does not constitute or create any contractual, fiduciary, or other fiduciary relationship with any person or entity. Each person or entity that receives a copy of Form 1065 (or a related return) is solely responsible for its own interpretation of, and compliance with, all tax laws under which it operates and for compliance with the terms of this document. The IRS may not provide more than general information on the use of tax-qualified funds. We do our best to supply accurate, current information, but it may include errors and omissions. Neither this document nor any other information received from the IRS constitutes legal advice or a legal claim and cannot be relied upon for other purposes. You are solely responsible for determining whether any portion of any return has merit in light of your particular circumstances, and you should exercise your own due diligence in assessing and determining the tax ability of any return. Taxation and Revenue New Mexico does not perform tax valuation or valuation research on behalf of any customer. Information provided is intended only to assist users in understanding the tax implications of an item of income, gain or loss; however, users should confirm the amounts of the item of income, gain, loss, deduction, credit or other item before engaging another company for the preparation of IRS forms; should prepare their own returns and obtain their own tax advice; and should make their own independent determinations regarding the legality of a payment. Please note that the State of New Mexico does not issue tax receipts. You are solely responsible for preparing, filing, and paying your own tax due and/or penalties and interest. Forms & Publication Information : Taxation and Revenue New Mexico For the most up-to-date versions of tax publications, please visit the Taxation and Revenue New Mexico webpage. Please fill out the form below to view and print a copy of our current tax publications. NOTE : This page requires some JavaScript to function properly.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete New Mexico Form Schedule K-1 (1065-B), keep away from glitches and furnish it inside a timely method:

How to complete a New Mexico Form Schedule K-1 (1065-B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your New Mexico Form Schedule K-1 (1065-B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your New Mexico Form Schedule K-1 (1065-B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.