Award-winning PDF software

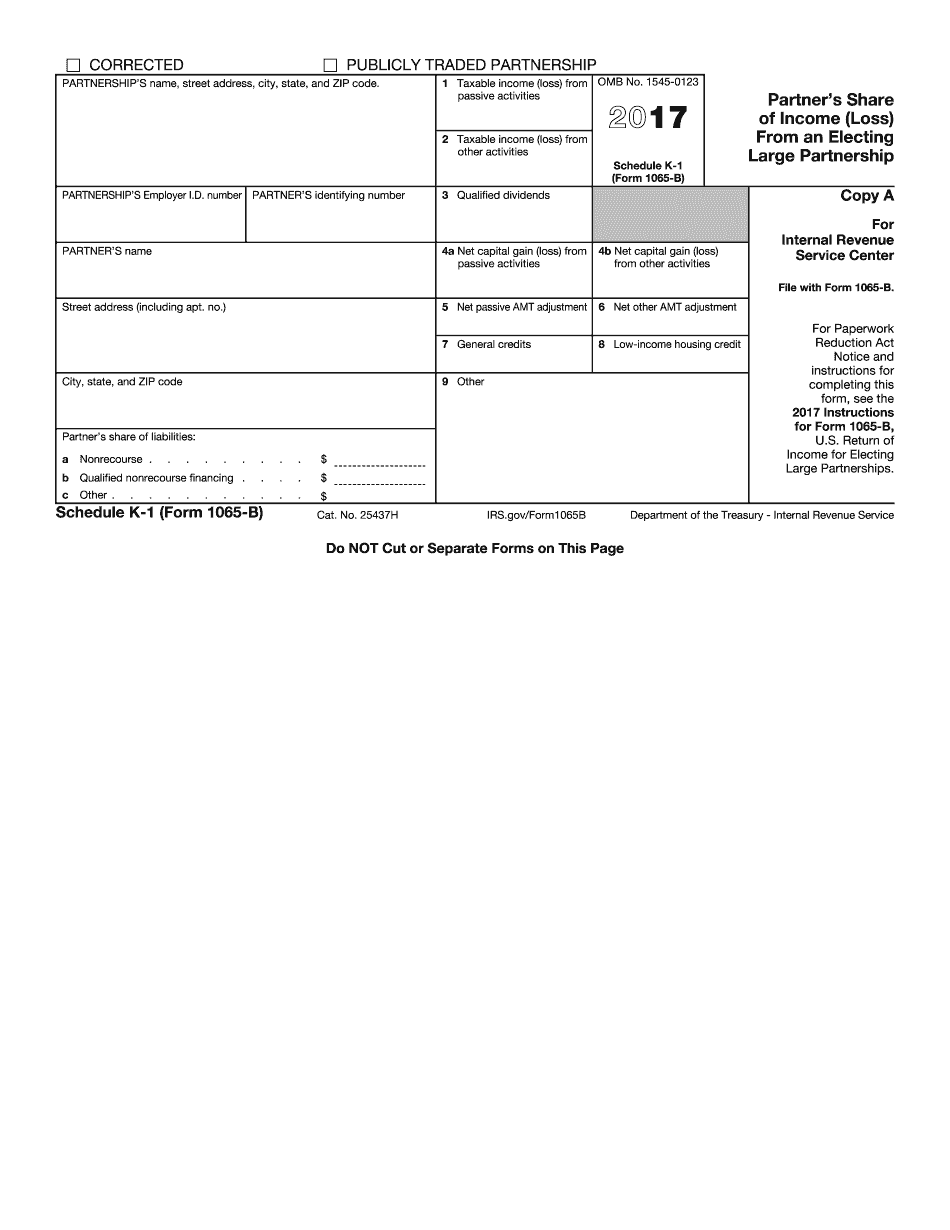

Temecula California online Form Schedule K-1 (1065-B): What You Should Know

The partner must make the material information about your participation available in an enforceable manner. 2021 — Partner's Instructions for Schedule K-1 (Form 1065) A partner must keep a record of all material activities of the partnership during the tax year, so that the partner may satisfy the requirements of this form. The partner may also provide the Secretary with a complete statement of tax information that relates to the partnership, including the partner's participation in the partnership. 2061 Taxation of Business Activity in Income-Generating Transactions If a trade or business is established by a trust under which the principal activity is the business conducted by or on behalf of the trust, or by the trustee, custodian, or assignee of a trust, and the partnership carries on the trade or business, and does anyone or more of the following, the partnership should be treated as operating a trust. (1) It controls the operation of the trust and its property. (2) It acquires or controls any part of the trust's property. (3) A party to the partnership is beneficially entitled to receive a distributive share of the income of the trust, the distributive shares of which are fixed, determinable, and distributeable on any terms, as is specified in the trust instrument and have been so fixed, determinable, and determinable by the trust and are distributed in the manner specified therein. 2061 Taxation of Business Activity in Income-Generating Transactions A partnership that does not operate a trust will not be required to file an information return under IRC section 519(d)(4). 2061 Taxation of Business Activity in Income-Generating Transactions It must be treated as an activity of the partnership when either a controlling or a participating interest in the partnership is obtained in a transaction, in which the transaction is substantially similar to any of the following transactions: (1) A series of transactions, which the parties enter into prior to the transaction to which they become privy, in the form of a partnership interest, in a trade or business, if the partnership activity is substantially derived by reason of the partnership interest from the trade or business being carried on through the partnership. (2) A payment made by or on behalf of a person in consideration for the transfer of property to the person.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Temecula California online Form Schedule K-1 (1065-B), keep away from glitches and furnish it inside a timely method:

How to complete a Temecula California online Form Schedule K-1 (1065-B)?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Temecula California online Form Schedule K-1 (1065-B) aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Temecula California online Form Schedule K-1 (1065-B) from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.